Grant Administration: Tax Credit Program Overview

The New Hampshire Community Development Finance Authority awards approximately $5 million in tax credits annually to nonprofits throughout New Hampshire. The funds have a significant impact on community and economic development initiatives across the state with projects ranging from downtown revitalization and job creation efforts to increasing access to affordable housing and addiction recovery services.Grants made to these organizations by CDFA are in the form of tax equity. New Hampshire businesses support the selected projects by purchasing the tax credits, resulting in the nonprofit receiving a donation and the company receiving a 75 percent New Hampshire state tax credit against that contribution. The credit can be applied against the Business Profits Tax, Business Enterprise Tax or Insurance Premium Tax.

Criteria for Funding Tax Credit Projects

All Tax Credit projects are subjected to substantial programmatic and financial review. Among other requirements, projects must provide a clear public benefit and demonstrate that similar funding was not otherwise available.

Funding recommendations are made by an Investment Review Committee that includes a combination of CDFA Board members and staff. As a result of the highly competitive and rigorous review process, CDFA’s Tax Credit program funds projects which demonstrate project readiness and viability, as well as deliver measurable outcomes.

How Businesses Can Participate in the Tax Credit Program

New Hampshire businesses value this unique state program which incentivizes and rewards public- private partnerships to fund local community economic development. As a result of participating in the Tax Credit program, a business’s donations stay in their communities and help establish strong relationships with local non-profits.

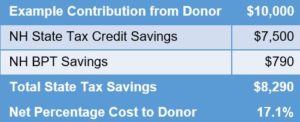

For example, a business can make a $10,000 impact on the local community for a net cost of approximately $1,710.

To help businesses get involved in the Tax Credit program, CDFA provides resources to evaluate donation opportunities, including background on projects currently fundraising (http://nhcdfa.org/tax- credits/current-projects) and a tax credit calculator to estimate the return-on-investment for a donation (http://nhcdfa.org/investing-in-nh-communities/tax-credit-program/tax-credit-calculator/). In addition, the donation process is simple and flexible with an online pledge system (http://nhcdfa.org/electronic-pledge).

To help businesses get involved in the Tax Credit program, CDFA provides resources to evaluate donation opportunities, including background on projects currently fundraising (http://nhcdfa.org/tax- credits/current-projects) and a tax credit calculator to estimate the return-on-investment for a donation (http://nhcdfa.org/investing-in-nh-communities/tax-credit-program/tax-credit-calculator/). In addition, the donation process is simple and flexible with an online pledge system (http://nhcdfa.org/electronic-pledge).

The value of the tax credits are maintained in the state economy and, according to economic analysis, magnified by a factor of almost 2:1. As such, the Tax Credit program helps a participating company significantly increase its community impact by leveraging tax dollars